maryland digital advertising tax litigation

And Marylands legal position remains a precarious one. This law parallels pending legislation in Connecticut Indiana West Virginia and New.

In early March 2022 a federal district court held that under the Tax Injunction Act it lacked jurisdiction over the suit challenging the tax.

. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served into the state. Chamber of Commerce the Internet Association NetChoice and the Computer and Communications Industry Association filed a detailed complaint in federal court in Maryland Thursday asserting the new Digital Advertising Gross Revenues Tax is clearly discriminatory. Two months later lawmakers.

Marylands digital advertising tax is the first of its kind in the US. Another lawsuit has been filed over Marylands gross receipts tax on digital advertising services this time in state court by subsidiaries of Comcast and Verizon. A stylized hypothetical involving an ad broker a seller of advertising space and an advertiser can help illustrate how lawmakers have failed to take the complexity of digital advertising into account in structuring the proposed tax.

5 for companies with revenue of 1 billion or more. 75 for companies with revenue of 5 billion or more and 10 for companies with revenue of 15 billion or more. Marylands Digital Advertising Tax Draws More Litigation.

The distinction is clever but not particularly compelling and there is legal precedent for invalidating laws requiring tax collections by. On March 4 2022 a federal judge ruled that the federal Tax Injunction Act TIA bars a challenge to Marylands Digital Advertising Gross Revenues Tax Digital Ad Tax from proceeding in federal district court but does not bar the plaintiffs from challenging Marylands prohibition on passing the tax to a customer by means of a separate fee surcharge or line. On March 4 2022 the United States District Court for the District of Maryland partially dismissed a challenge to the Maryland Digital Advertising Gross Revenues Tax.

The plaintiffs asserted that the Tax violates the Internet Tax Freedom Act and the Commerce and Due Process Clauses of the United States Constitution. Its modeled after the digital services taxes weve seen adopted in. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland.

The suit lands most of its blows under the Internet Tax Freedom. The governor vetoed it and the House let it rest until February 2021 when it overrode the veto. Or two years as the case may be.

The federal court held that the Tax Injunction Act applied and. The governor vetoed it and the House let it rest until February 2021 when it overrode the. The law would tax revenue the affected companies make on digital advertisements shown in Maryland.

Four business associations commenced litigation last week against the Maryland Comptroller in a federal district court seeking a declaration and injunction against enforcement of the digital advertising gross revenues tax on sellers. Marylands position has not been to deny the thrust of PITFA but to hope that courts will adopt a saving interpretation that concludes that the tax is really on contracts for digital advertising and not the advertising itself. The Maryland state legislature recently enacted a tax on digital advertisements that could present major ramifications for any company that sells or purchases digital advertisements in Maryland.

The bill is pending action by the governor who has 30 days to sign veto or allow the bill to become law without his action. The tax rate would be 25 for businesses with gross annual revenue of 100 million. And Marylands legal position remains a precarious one.

Marylands digital ad tax faces litigation but tax could see broader adoption. The Digital Advertising Tax is the first of its kind in the United States. Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14.

Maryland recently became the first state to pass a digital advertising services tax but analysts are waiting to see what courts think of the law before hitting the panic button. Taxation of digital advertising services. In March 2020 Maryland lawmakers adopted legislation creating a first-in-the-nation tax on digital advertising served into the state.

Lets back up a minute. Lawsuits challenging Marylands digital advertising tax on Due Process and Commerce Clause grounds and on the basis that the tax violates the Internet Tax Freedom Act were filed in state and federal court. The Maryland Digital Advertising Tax on the verge of a veto override remains a vague concept in search of.

2 The regulations provide a set of rules for sourcing digital. 22 The litigants are arguing that the tax violates the permanent Internet Tax Freedom Act as well as the Commerce and Due Process. Review the latest information explaining the Comptroller of Marylands.

Earlier this month Marylands state legislature overrode a veto from the governor to pass a first-of-its-kind tax on. This page contains the information you need to understand file and pay any DAGRT owed. Or two years as the case may be.

1 This tax which is intended to be imposed on the annual gross receipts derived from certain digital advertising services provided in Maryland became effective on Jan. Litigation is pending in federal and state courts seeking to bar implementation of the Maryland digital advertising gross revenue tax but a final decision appears unlikely in time for the compliance deadlines beginning with the first estimated tax payment due April 15 2022. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

The tax applies to annual gross revenue derived from digital advertising in the state and is imposed at scaled rates between 25 and 10 beginning with taxpayers that have at least 100 million in global annual gross revenue. Lets back up a minute. The Maryland General Assembly on April 12 2021 passed Senate Bill 787legislation that revises two digital services tax laws enacted earlier this year.

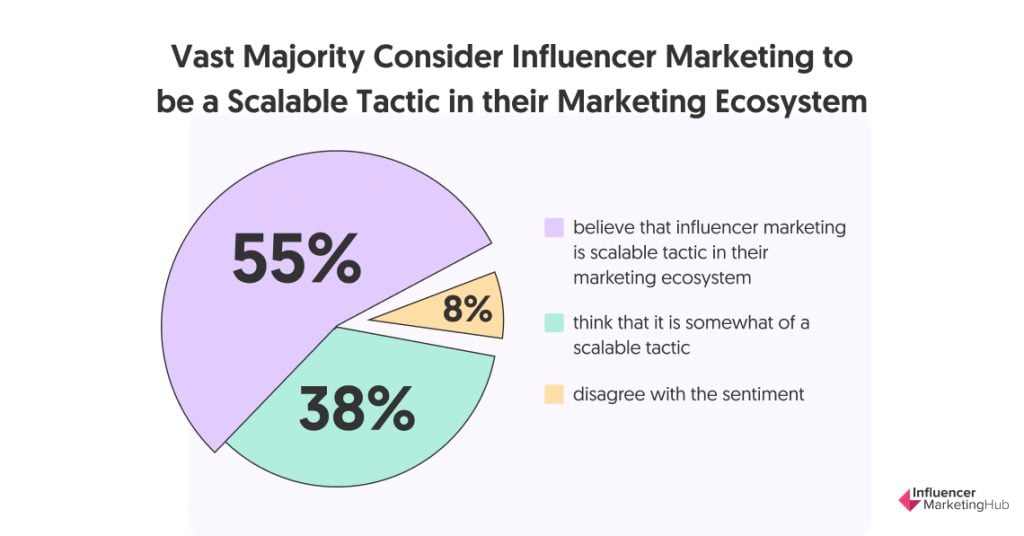

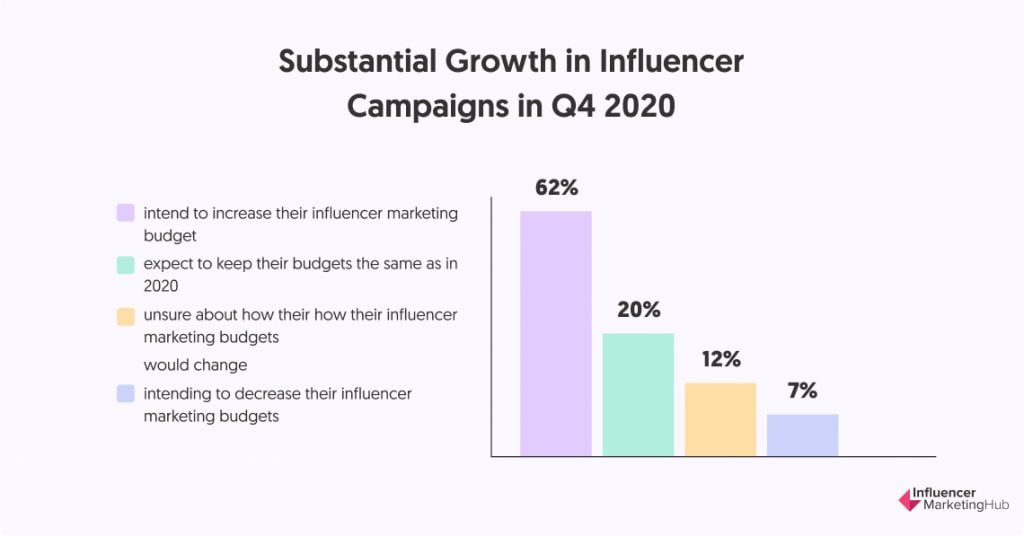

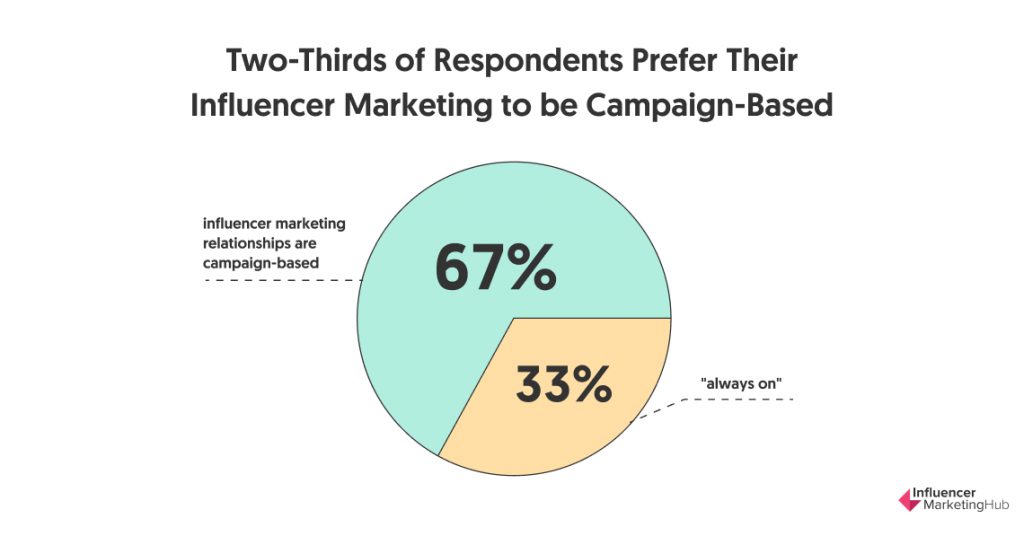

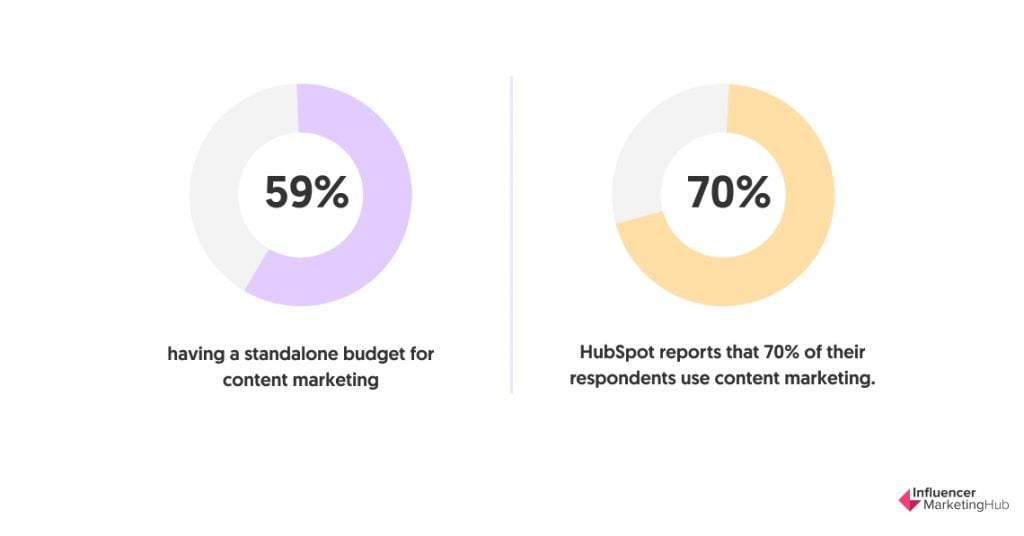

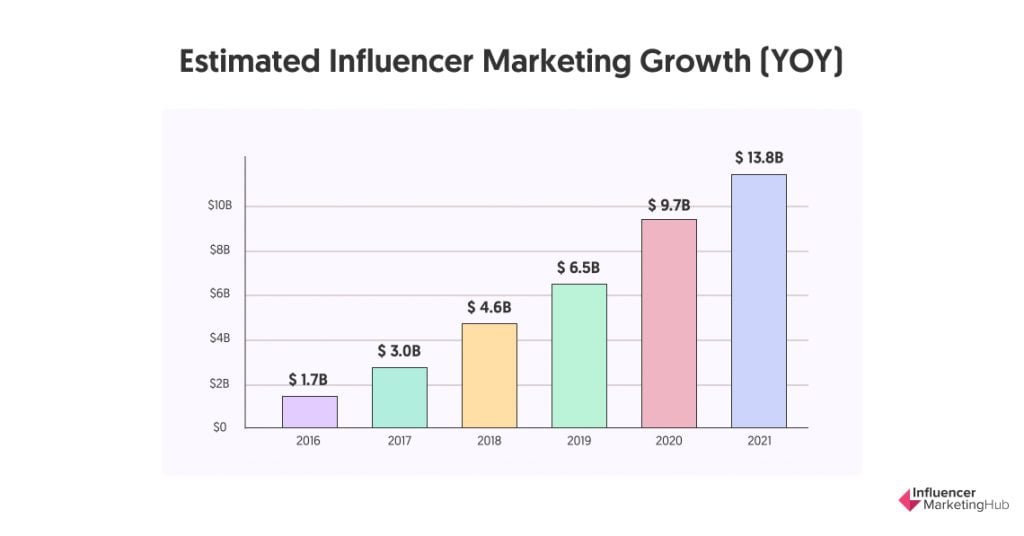

The State Of Influencer Marketing 2021 Benchmark Report

Regulatory Overdrive Institute For Justice

U S Senate Panel Advances Public Defender Vets Up For Judgeships Reuters

The State Of Influencer Marketing 2021 Benchmark Report

The State Of Influencer Marketing 2021 Benchmark Report

Buffalo Gunman Aimed To Keep Killing After Supermarket Shooting Police Say Maryland Daily Record

Robert Half Hauppauge Ny Hauppauge Staffing Agencies Recruiters Staffing Agency Marketing Jobs Recruitment

Black Security Guard S Major Win Against U S Tennis Is Double Edged Reuters

The State Of Influencer Marketing 2021 Benchmark Report

The State Of Influencer Marketing 2021 Benchmark Report

Former Clients Say Online Marketing Coach Owes Them Thousands For Failed Business Deals Nbc4 Washington

A New Era Of Invoicing With The Crowdz Invoice Auction

Disbarred Chevron Foe Donziger Pleads For Time Served Sentence Reuters

The State Of Influencer Marketing 2021 Benchmark Report

The State Of Influencer Marketing 2021 Benchmark Report

Frankfurt Kurnit Klein Selz By Gensler Escaleras

Hud And Lihtc Compliance Help File Audits Pre Mor Us Housing Consultants

Massachusetts Legislature Considering Multiple Digital Advertising Tax Proposals Salt Shaker